Kuala Lumpur, 10 July 2025 — Bank Negara Malaysia (BNM) has announced a reduction in the Overnight Policy Rate (OPR) by 25 basis points, bringing it down from 3.00% to 2.75%. This move comes amid ongoing efforts to support economic growth and ease financial conditions for households and businesses.

But what does this really mean for everyday Malaysians? And how does it affect your home loan or car loan?

Let’s break it down.

🔎 What Is the OPR?

The OPR is the interest rate at which banks lend money to one another overnight. When BNM adjusts the OPR, it influences Base Lending Rate (BLR) ,Base Rate (BR) and Standardise Base Rate (SBR) used by banks to determine the interest on loans and savings.

A lower OPR typically leads to:

✅ Lower loan interest rates

✅ Cheaper monthly repayments

✅ Easier access to credit

🏠 Before & After: Sample Loan Calculation

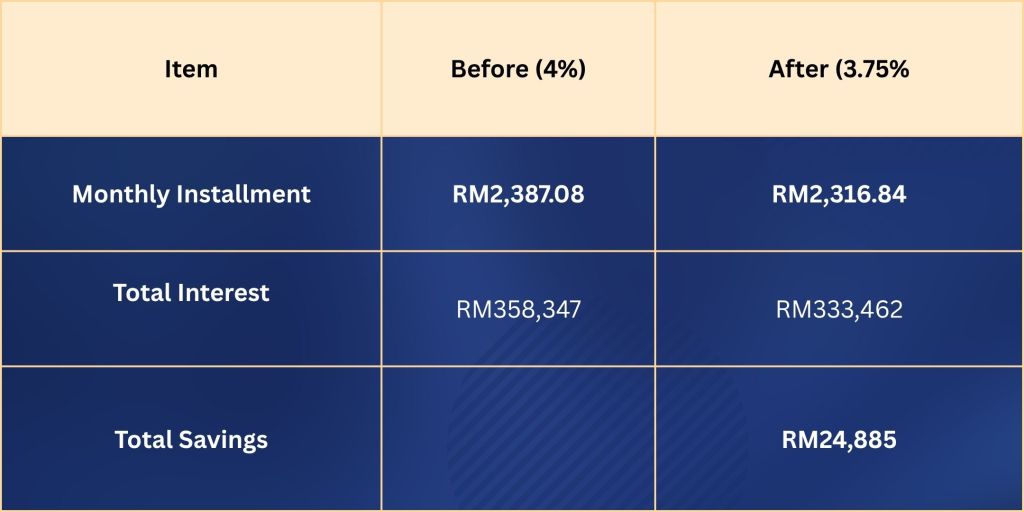

Let’s compare how the OPR cut affects a typical housing loan of RM500,000 over 30 years.

Assume a floating interest rate of:

- Before: 4.00% (based on 3.00% OPR)

- After: 3.75% (after 2.75% OPR cut)

🔹 Before OPR Cut (4.00%)

- Loan amount: RM500,000

- Tenure: 30 years

- Interest rate: 4.00%

- Monthly instalment: RM2,387.08

- Total interest over 30 years: RM358,347

🔻 After OPR Cut (3.75%)

- Loan amount: RM500,000

- Tenure: 30 years

- Interest rate: 3.75%

- Monthly instalment: RM2,316.84

- Total interest over 30 years: RM333,462

💡 You Save:

- Monthly: RM70.24

- Over 30 Years: RM24,885 in interest!

📌 Summary:

📉 Impact Beyond Housing Loans

The OPR cut doesn’t just affect home loans. It also impacts:

- Car Loans – Lower monthly repayments

- Personal Loans – Cheaper borrowing

- Business Loans – Reduced financing costs

However, fixed-rate loans (such as some hire purchase loans) are generally not affected by OPR changes.

🏦 Why Did BNM Cut the OPR?

BNM’s Monetary Policy Committee cited the need to:

- Support domestic economic activity

- Manage downside risks from global uncertainties

- Encourage spending and investment

With inflation under control and growth momentum slowing, the rate cut is intended to provide a cushion and maintain financial stability.

📊 Conclusion: A Relief for Borrowers

If you’re repaying a floating-rate loan, this OPR cut could offer welcome breathing space in your monthly budget. For potential homebuyers, it’s a good time to recalculate affordability and consider locking in better financing packages.

🔍 Tip: Contact your bank to check how the OPR cut affects your current loan rate. You may also explore refinancing options for better savings.

From The Desk of

Miichael Yeoh

Leave a comment