Introduction

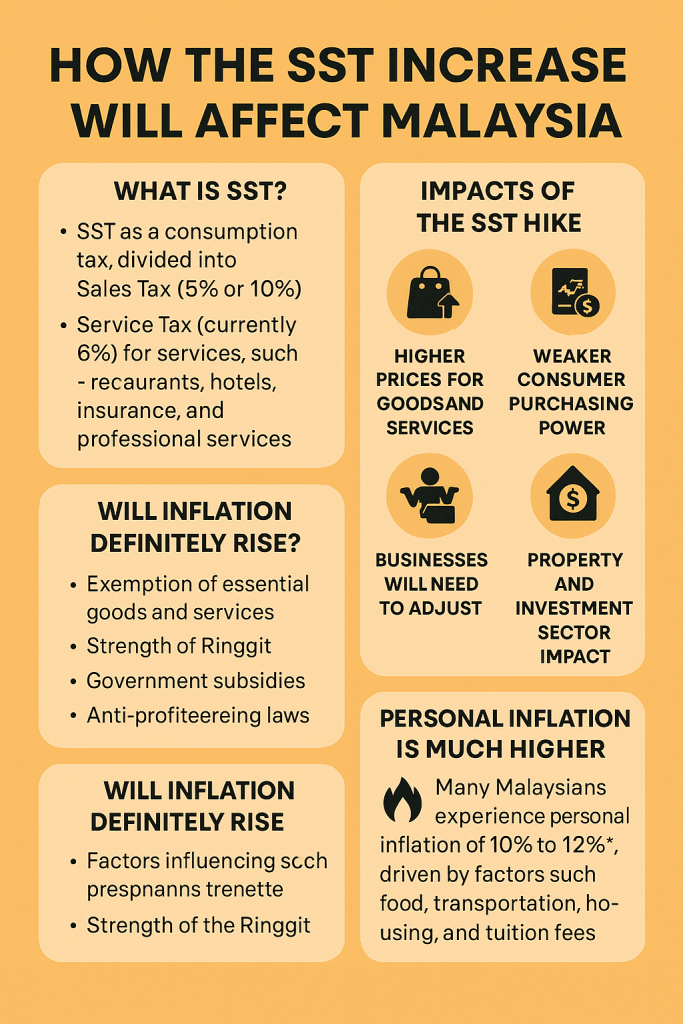

Starting July 1, 2025, the Malaysian government officially raised the Sales and Services Tax (SST) from 6% to 8%, aiming to increase national revenue and reduce fiscal deficits. While basic necessities and certain essential services remain exempt, many sectors — including construction, legal, professional, and property-related services — are now affected. This tax adjustment is expected to have ripple effects across various industries, especially the property market, which is already facing affordability challenges.

This article examines how the SST hike impacts the property industry, giving practical examples and offering insights into how buyers, developers, and investors might respond.

1. Scope of SST Increase in the Property Sector

The SST increase does not apply directly to the sale of residential properties, which are exempt from SST. However, indirect costs will go up due to increased service charges in the construction, legal, and property management sectors. These cost increments will eventually be transferred to end buyers and tenants, especially in commercial and high-rise residential developments.

2. Areas Affected in Property Development

Here’s a breakdown of how the 2% SST increase affects the property ecosystem:

| Service Type | Base | Old SST (6%) | New SST (8%) |

|---|---|---|---|

| Architect/Engineer Fees | RM100,000 | RM106,000 | RM108,000 |

| Legal/Stamping Services | RM20,000 | RM21,200 | RM21,600 |

| Renovation/Interior Fit-Out | RM150,000 | RM159,000 | RM162,000 |

| Property Management Services | RM50,000 | RM53,000 | RM54,000 |

| Advertising & Marketing | RM30,000 | RM31,800 | RM32,400 |

Example:

A developer constructing a new serviced apartment project incurs around RM5 million in professional and management fees. Under the previous 6% SST, the tax was RM300,000. Now, it’s RM400,000 — a 33% increase in SST cost, which could result in higher launch prices to maintain developer margins.

3. Impact on Property Developers

- Higher Development Cost: Most developers will face a 5–8% increase in overall project costs when combined with inflation and compliance costs.

- Price Adjustment Pressure: Developers may either absorb the cost (lowering margins) or pass it to consumers — likely raising launch prices, especially in urban areas.

- Delay in New Launches: Some developers may delay project launches until market conditions stabilize.

4. Impact on Homebuyers

Although SST is not directly charged on residential property purchases, buyers may feel the pinch in several ways:

- Higher Property Prices: Due to rising development and marketing costs.

- Increased Renovation Expenses: Renovation and interior design are service-based industries and are now charged 8% SST.

- Increased Maintenance Fees: Management services in condos or commercial buildings may increase, translating to higher monthly maintenance charges for owners and tenants.

5. Impact on Real Estate Investors

Investors will also be affected indirectly:

- Lower Rental Yield: If property prices go up but rental rates remain stagnant, net returns will shrink.

- Higher Operational Costs: Especially for those managing short-term rentals or Airbnb units (cleaning, advertising, renovation services all now taxed at 8%).

- Buyer Caution: Investors may delay purchases or switch to lower-risk assets like REITs or landed residential properties outside city centers.

6. Outlook and Strategies

Despite the challenges, the SST increase may drive some positive changes:

- Developers may adopt cost-efficiency technologies to maintain affordability.

- Buyers may turn to subsale markets, which are less affected by SST-related costs.

- Investors may focus on cash-flow-positive properties, especially those with low operating costs.

Conclusion

The SST increase from 6% to 8% might seem modest on paper, but its cascading effect across the property value chain is real. While residential property sales remain tax-exempt, associated services — from construction to maintenance — will become costlier. As developers adjust pricing and investors reassess risk, Malaysia’s property market may experience a short-term slowdown but could stabilize as the market adapts.

Final Thought

For both buyers and investors, 2024–2025 will require careful financial planning and a close eye on property pricing trends. Understanding the real costs behind the price tag is more important than ever.

From The Desk of Miichael Yeoh

Leave a comment